The Definitive Guide to Eb5 Visa

Table of ContentsFacts About Eb5 Visa UncoveredThe 20-Second Trick For Eb5 VisaEb5 Visa Fundamentals ExplainedThe 20-Second Trick For Eb5 Visa

The conditions needed for a full reimbursement of a capitalist's money upon rejection can differ from one investment to an additional.This fund is designed to make sure that capitalists have a method to recover their funding in such scenarios. It is also crucial to consider the entity in charge of making the repayment. Given that the investor's funding is typically currently spent by the time of an application rejection, the process of returning the funds might include coordination in between different entities within the financial investment structure.

Financiers need to seek support from migration lawyers and investment experts that can help them navigate the certain terms and arrangements of their investment and make certain a thorough understanding of the possible circumstances and end results, including the treatments for resources settlement in case of denial. The term 'in danger' in the context of the EB-5 program refers to the demand that an investor's resources have to be purchased a manner that includes the possibility for both financial gain and the possibility of loss.

It is necessary to understand that the "in jeopardy" need restricts any assurances of returns, including ensured passion prices. If there are any guarantees made to the investor, such as civil liberties to own or use realty, the value of those guarantees will be subtracted from the total amount of capital taken into consideration to be in jeopardy.

Eb5 Visa Can Be Fun For Anyone

The function of this financial investment is to sustain an organization that develops jobs and takes part in organization activities using the spent funding. Nonetheless if the organization is not effective, there is a risk of losing the capitalist's resources. This 'in danger' requirement need to be kept for two years following the financial investment being made

Debt investments normally have a greater priority of settlement compared to equity financial investments. It is crucial for capitalists to completely evaluate the car loan papers to recognize the civil liberties and treatments afforded to the lending institution, which in this situation is the EB-5 investor's fund. In the case of a preferred equity investment, capitalists need to very carefully review the operating contract of the developer (JCE) to comprehend the rights and advantages connected with their financial investment.

Recognizing these distinctions will certainly aid financiers make educated choices regarding their EB-5 investment.

Everything about Eb5 Visa

These disputes might stem from the structure of settlement, usual possession, or motivations offered to particular celebrations. Evaluating and recognizing these potential disputes is of utmost relevance for financiers.

Project Assessment: Review the regional facility's due diligence procedure for selecting tasks. Examine the local facility's evaluation of job stability, consisting of learn more marketing research, financial analysis, and danger evaluation. Take into consideration the track document of effective project execution by the regional. Transparency and Financier Defense: Testimonial the regional facility's disclosure papers, such as the Private Positioning Memorandum (PPM), to make certain clear and detailed info is provided to financiers.

Evaluate the regional facility's investor protection actions and systems for dealing with escrowed funds. By concentrating on the local facility's duty as a project enroller and manager, financiers can analyze the center's commitment to regulative compliance, protections conformity, and capitalist security. This technique helps recognize regional facilities that prioritize transparency, due diligence, and adherence to guidelines, advertising a much more safe and reputable EB-5 investment opportunity.

Not known Facts About Eb5 Visa

It is important to extensively review such assurances, making sure that the guarantor's net worth and liquidity have been examined to maintain their EB5 Visa requirements commitment. In some circumstances, assurances might not supply the guaranteed protection for capitalists if not correctly vetted. Financiers should realize that payment of management charges is not a common practice in the EB-5 program.

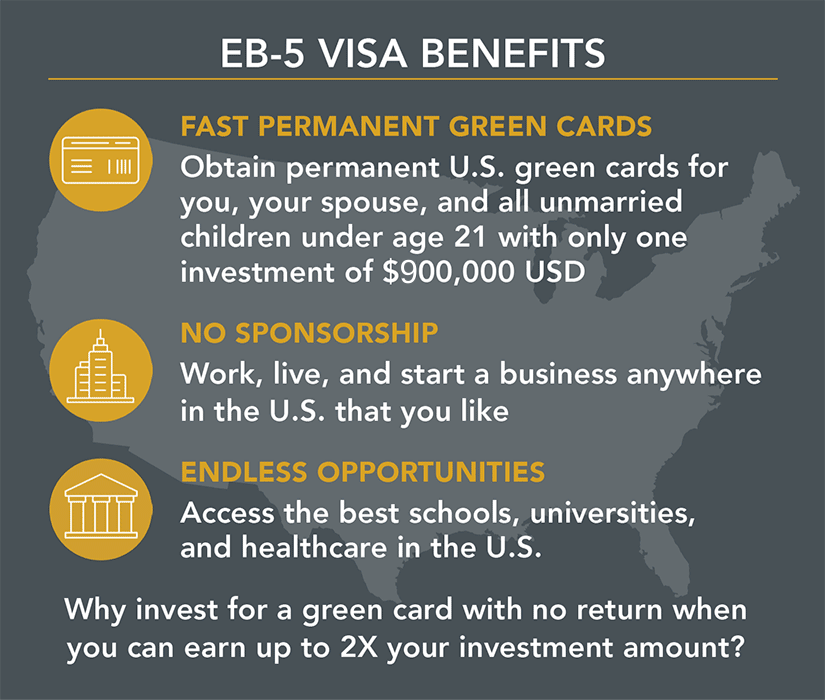

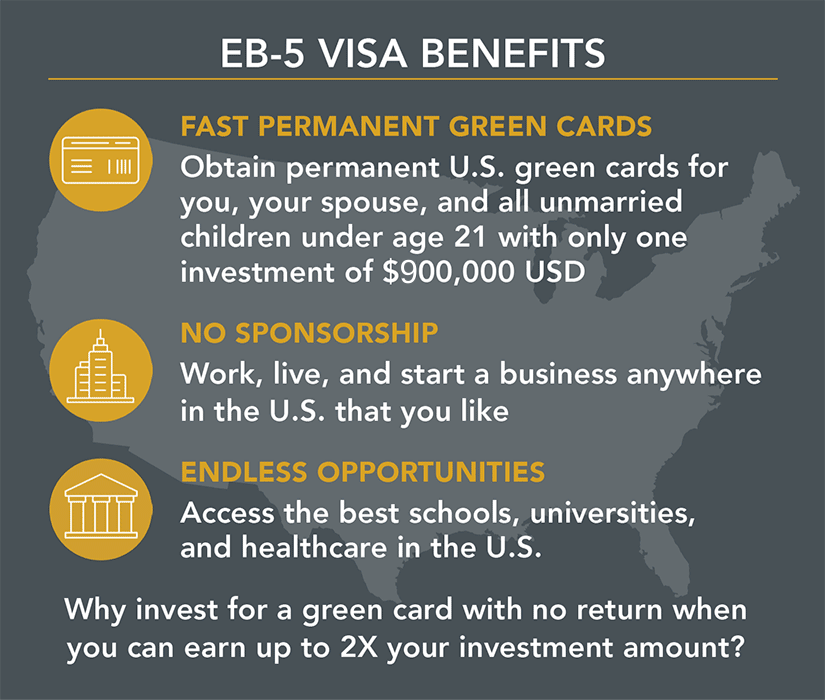

Once the charges have been paid, they are usually considered non-refundable as they have actually currently offered their purpose in sustaining the operational facets of the financial investment procedure. The EB-5 copyright uses a number of advantages compared to various other visas in the United States. The EB-5 visa gives permanent residency status, which grants people the capability to live and work anywhere in the United States.

Another benefit is the academic chances it offers kids. EB-5 financiers can make use of reduced tuition prices at united state universities, permitting their youngsters to get high quality education and learning at even more inexpensive costs. This can be a significant motivation for households looking for to supply their youngsters with exceptional educational potential customers.

This means that EB5 Visa law firm candidates are not obligated to demonstrate efficiency in English or any kind of various other particular language. This can be advantageous for people who may not have solid language abilities or are more comfortable in their indigenous language. Furthermore, after holding an EB-5 Permit for a minimum of five years, individuals come to be qualified to request united state. In particular situations, the NCE may choose to lend the capital increased from investors straight to the Job Creating Entity (JCE) or via an intermediary. This enables the JCE to utilize the funds for work creation efforts, company growth, or various other qualifying tasks. By spending or providing the resources to the JCE, the NCE indirectly sustains the essential need of job development within the EB-5 program.